RAPID Chairman Dr M A Razzaque was invited to the talk show ‘How’s the Economy?’ conducted by BTV to discuss why export development is necessary.

Policy Blog: Bangladesh’s Growth Illusion: Where Are the Jobs?

RAPID Data Centre (RDC)

Monthly Data

Table 1: Breakdown of Asia-Pacific LDC exports by types of tariffs they face on their exports

| Items | FY2024-25 | Remarks | ||

|---|---|---|---|---|

| February | January | December | ||

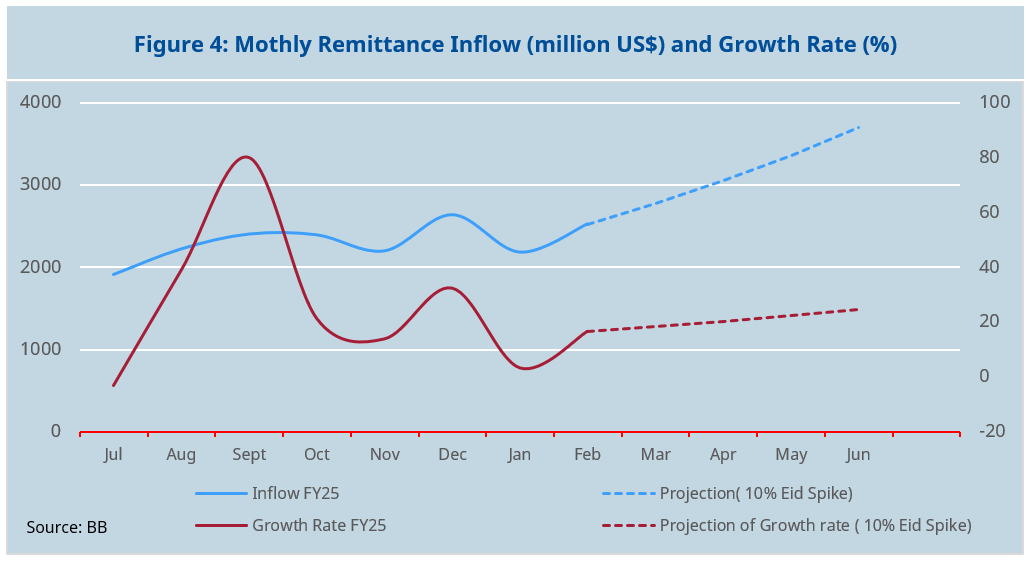

| Remittance inflow ($B) | 2.53 | 2.19 | 2.64 | The data suggests seasonal fluctuations in remittance inflows, with a dip in January and a recovery in February. External factors like festive seasons, policy changes, and economic conditions in host countries might be influencing these trends. |

| General inflation (%) | 9.32 | 9.94 | 10.89 | The steady decline in inflation from 10.89% in December to 9.32% in February is a positive sign. However, authorities need to ensure that the reduction is supported by sustainable economic policies rather than temporary factors. |

| Food Inflation (%) | 9.24 | 10.72 | 12.92 | Food inflation has dropped from 12.92% in December to 9.24% in February, which is encouraging. However, policymakers should ensure continued price stability to prevent future spikes, especially with upcoming Ramadan demand. |

| Non Food Inflation (%) | 9.38 | 9.32 | 9.26 | Non-food inflation has shown minor fluctuations but remains stable. While it hasn't declined like food inflation, it also hasn't spiked significantly. Monitoring energy prices and exchange rates will be important in predicting future trends. |

| Foreign Exchange Reserves (as per BPM6 )_($B) | 2-.95 | 19.96 | 21.39 | Bangladesh’s foreign exchange reserves declined in January but rebounded in February. Continued monitoring of remittance trends, import payments, and external debt obligations is necessary to maintain a stable reserve position. |

| Nepal | 4% | 0% | 22% | Almost 60% of Nepal’s exports go to India, where they receive preferential treatment under a bilateral FTA (unrelated to LDC status). |

| Solomon Islands | 10% | 73% | 5% | Main exports, wood and articles of wood, usually have MFN zero tariff in importing destinations. |

| Timor-Leste | 1% | 2% | 97% | Mineral exports face MFN duty-free treatment in importing countries. |

Yearly Data

Since the adoption of the Sustainable Development Goals (SDGs) in 2015, a series of global shocks have adversely affected growth and development prospects for developing countries.The first in the lot was the massive trade slowdown of 2015 and 2016; then the US-China trade war causing global trade to plunge; followed immediately by the Covid-19 global pandemic inflicting severe losses and damages to lives and livelihoods across the globe; then the Ukraine war leading to food and energy price hikes; and now a full-blown cost-of-living crisis with the IMF and others suggesting the world economies to experience a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades.

Given all this, attaining the SDGs now looks more daunting than ever. It is perhaps high time to identify a more realistic and trimmed set of targets, from the originally prespecified list of 169, and make serious global efforts to achieve those. Extending the timeline can be another option.

It is also important to review the LDC graduation timelines for the countries that qualified to do so. The global economy is facing unprecedented crises, and merely setting up ambitious goals and targets will not serve the purpose.

Yearly Data

Over the past decade, China's share in EU imports of clothing items has fallen. Bangladesh has been able to capture much of China's lost share. China has lost its share in the US market as well, but Vietnam has been the main beneficiary. The duty-free market access that the EU grants to the least developed countries (LDCs) has helped Bangladesh. The US has never given such preference to Asian LDC exporters of apparel items. The striking contrast between EU and US markets bears important implications for Bangladesh's graduation from the group of LDCs (set to take place in 2026).

International Trade

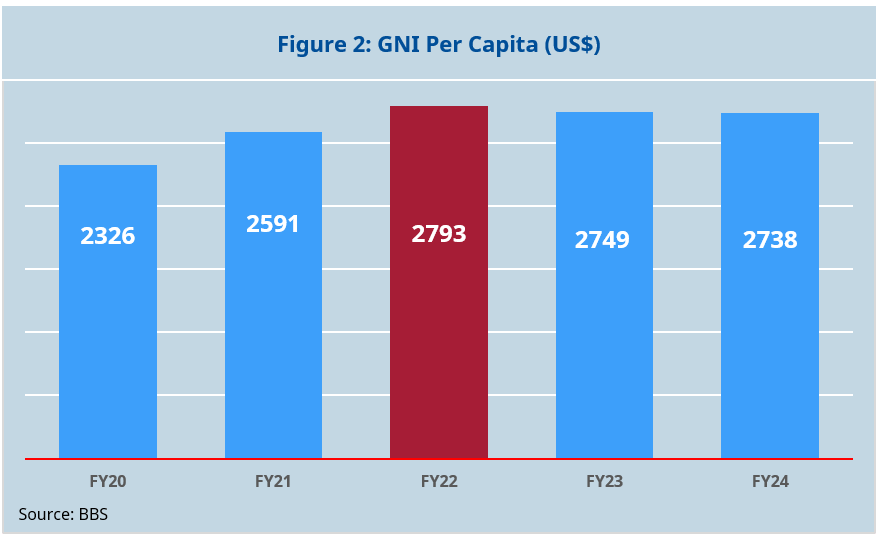

Figure 1 shows that Bangladesh's GDP grew by 4.22% in FY2023-24, marking the slowest growth in the past four years. Figure 2 indicates that FY24 recorded the lowest GNI per capita in Bangladesh compared to the previous three years.

Figure 3 shows that for FY 2024-25, ADB has projected a conservative GDP growth forecast of 4.3%. Figure 4 illustrates that remittance inflow in the first seven months of FY25 has been around $16 billion (approximately $2.3 billion per month). If this trend continues, the total remittance inflow for the fiscal year is expected to reach around $28 billion. Additionally, with an anticipated spike of over 10% before the two Eid festivals, the total inflow could potentially reach $30 billion.

The Low-Hanging Fruit That Remains Elusive

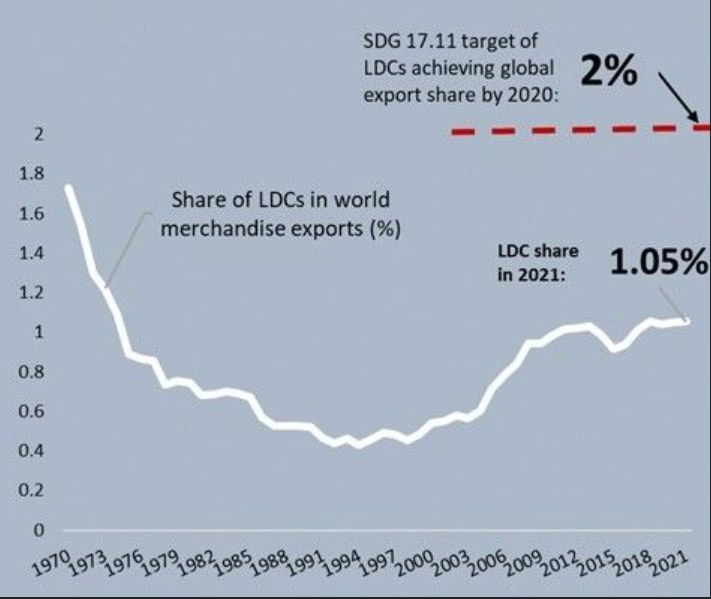

During the three decades of 1970—2000, the combined share of 48 UN-designated least developed countries (LDCs) in global merchandise exports fell from 1.72 per cent to just 0.45 per cent. Then the global community became upbeat about the revival of LDC trade performance as its global export share more than doubled to 1 per cent in 2011. Expectations were so high that one of the Sustainable Development Goals (SDGs) set a target of the LDC share of global exports doubling further to 2% by 2020 (yes, 2020 and not 2030 as the stipulated target date for most other indicators). Since the adoption of the SDGs in 2015, the relative significance of LDCs in global export trade has virtually stagnated at 1 per cent. Achieving a 2 per cent share even by 2030 now looks like a daunting prospect. But still, it is most appropriate to fix a new timeline for this target (SDGs 17.11.1).